Buy Low, Sell High

Though, we all know that for generating reasonable returns, any investor should ‘Buy Low and Sell High’, yet, for an individual investor this is easier said than done. It is not only difficult to track the market on a continual basis, while diversifying the risk, but it is also difficult to have the heart to buy beaten down stocks when market has fallen substantially and sentiments are running low.

Besides, with increase in losses, the gain needed to break-even also increases. Moreover, for an investor, the pain of selling a stock at a loss far exceeds the pleasure of selling the stock at an equal amount of gain. Hence, the importance of containing the downside to the portfolio cannot be emphasized enough.

That is where the expertise and knowledge of a fund manager comes into play – in selection of appropriate asset class at any given time while lessening the psychological pain of investors.

Dynamic Asset Allocation Strategy

Balancing exuberance with caution, a dynamic asset allocation strategy uses the market volatility as an opportunity for switching between asset classes to benefit from growth of equity market while reducing the volatility of returns.

With the example of ICICI Prudential Balanced Advantage Fund, I proceed to explain how a dynamic asset allocation strategy allows for capital appreciation, while limiting the impact of loses on your portfolio.

ICICI Prudential Balanced Advantage Fund (BAF)

BAF is based on the wisdom of buying low and selling high.

Source: https://www.icicipruamc.com/icici-prudential-balanced-advantage-fund

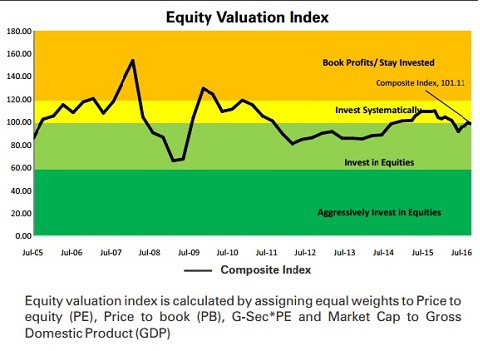

Using an in-house Price –to-Book Value (P/BV) Model, the fund allocates higher in equity when the Equity Market Valuation is low and reduces its equity exposure when the Equity Market Valuation is high. The equity exposure of the fund, which is a blend of large and midcap stocks, varies from 30% – 80%. A core debt portfolio is used for rebalancing.

This minimizes the role of emotions in investment decisions and helps to remove the psychological barriers (greed and fear) for its investors. The investor, thus, stands to gain more in a rising market and lose comparatively lesser when the market falls.

Alternative to Fixed Deposits

Asset allocation by individuals is driven by their risk appetite, market opportunities, and the liquidity requirement from their investment at any given time. The most common instrument into which most retail investors in India put their money are fixed deposits (FDs).

BAF is a great alternative to FD for parking cash. The returns have been consistently higher in comparison to FDs. The fund also offers an Automatic Withdrawal Plan to manage your monthly cash requirements. Additionally, BAF generates tax savings for investors. The returns from BAF become tax free after one year while the returns from FDs continue to be taxed.

Derivative Strategy

To qualify for such equity-like tax treatment, it is mandatory that the funds’ exposure to equity must remain at 65%. But, as mentioned above, the BAF equity exposure varies from 30% – 80%. In order to maintain the equity exposure at 65%, in rising market conditions, whenever the fund’s allocation to equities is reduced below 65%, portfolio re-balancing is done by investing the remaining amount (short of 65%) in derivatives, and the rest in fixed income securities.

Returns in All Types of Market Conditions

Source: https://www.icicipruamc.com/icici-prudential-balanced-advantage-fund

Though past performance may not necessarily be indicative of performance in future, it is reasonable to point out that as per MFI data in % CAGR terms, the fund has consistently outperformed both standard benchmarks Sensex and Nifty since March 01, 2013 to Sep 30, 2016, thus creating wealth for the investors. The fund has a consistent dividend history as well.

The ability to generate good returns in all types of market conditions makes BAF suitable for investors with a moderate risk appetite, seeking long term wealth creation while limiting the downside.

A dynamic asset allocation fund could be a most suitable investment option when the equity market valuations are not very attractive. #TarakkiTalks

Also, it helps to remember that an investment horizon of 3 – 5 years is needed to reap the full advantage of such a fund.

This post is written in collaboration with Blogmint and ICICIPrudential.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Investors should consult financial advisors, when in doubt about the suitability of a product for them.

I have a few MF investments, will check them out too! Thanks.

LikeLike

Thanks Alok. Always good to keep checking. 🙂

LikeLike

The Warren Buffet quote is absolutely true! Will check out this AA fund…useful info here, Somali… 🙂

LikeLike

Thank you Maniparna. 🙂

LikeLike