In 2014, South Africa came to be known as the ‘safe haven’ for investors among the Emerging Markets. A comparison of the BRICS nations with developed nations on parameters of corporate governance, as reported in the World Economic Forum Global Competitiveness Report 2013-14, shows us why.

Good corporate governance and ethical practices by companies are considered essential for well functioning capital markets all over the world. Ethical practices, transparency in dealings, better investor protection and efficient boards boost investor confidence and lead to capital inflows in markets.

Ethical Behavior of Firms

Ethical behavior is assessed by company policies on bribery, kickbacks, protection money, facilitation payments, gifts, fraud, money laundering, and political and charitable contributions. Management systems and procedures outlining frameworks for risk assessment, sanctions, whistle-blowing, continuous internal self-review and external reporting also fall under the purview of ethical behavior.

In 2013, South Africa ranked at No37 on ethical behavior, ahead of other BRICS nations, with China at a distant 54th rank. India & Brazil ranked 86th and 87th and Russia ranked the lowest among BRICS nations on this parameter.

Strength of Auditing and Reporting Standards

Fair practices and transparency in dealings are critical to attracting foreign investments. The use of auditing and accounting practices ensure transparency against fraud and mismanagement and so are particularly important for investors to invest in foreign markets.

South Africa ranks at No 1 in auditing and reporting standards, ahead of UK and US. Surprisingly Brazil ranks ahead of the US in auditing standards.

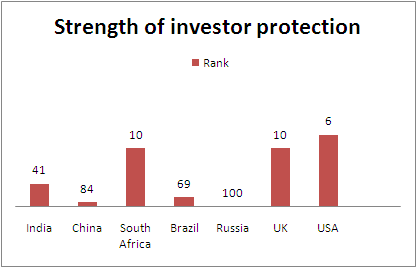

Strength of Investor Protection

There is a strong correlation between investor protection in a country, the legal and regulatory environment of the country and ownership structure of listing corporations in the country. In Asian countries, the concentrated pattern of ownership presents additional challenges for protection of interests of minority shareholders against expropriation by the controlling shareholders.

South Africa with a ranking comparable to UK, ranked the highest among the BRICS nations on investor protection. India ranked ahead of Brazil and China on Strength of investor protection.

Efficacy of Corporate Boards

Company boards have responsibility towards safeguarding the interest of shareholders and increasing transparency. An efficient board guides a business through its understanding of the structure of business, its strategies, key performance issues and major risks in context with the market environment, relevant laws, regulations and industry policies. South Africa ranked at No 1 in the efficacy of corporate boards. Brazil ranked ahead of India and China in this area.

Thus we see that among the BRICS nation, South Africa ranked highest on all parameters. The high quality corporate governance earned South Africa the reputation of safe haven in the emerging markets in 2014, exactly the opposite of Russia, which ranked the lowest among on all parameters among the BRICS nations. Though India ranked ahead of China on all 4 parameters except for Ethical Behavior of firms, there is sufficient room for improvement in corporate governance standards.